The foreign exchange reserves held by the central bank fell to $4.5 billion after Pakistan returned over $1 billion loans of two foreign commercial banks, hardly enough to finance 25 days of import.

Two separate repayments of $600 million and $415 million have been made to two Dubai-based commercial banks, according to reports. After the loans repayments, Pakistan is left with less than 25 days of import cover.

It is pertinent to mention here that the economic activities in the country have already been severely affected due to depleting reserves, devaluation of local currency and non-opening of letter of credits (LCs) for private companies.

Major industries, including car manufacturing companies, have temporarily closed their plants due to import restrictions.

According to reports, Pakistan is expecting to raise around $1.5 to $2 billion worth of funds in foreign aid during Geneva Conference to be held next week for the country’s flood victims. Besides, efforts are also underway to arrange loans from Saudi Arabia and China. It is expected that Pakistan and International Monetary Fund ((MF) will hold discussion next week for the completion of the pending 9th review of the programme.

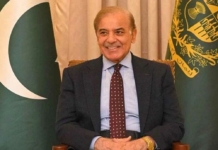

If the pending review is completed successfully, Pakistan will get a loan installment of over $1 billion from the IMF. Prime Minister Shehbaz Sharif has also requested the IMF managing director to immediately send over a team to the country to start review negotiations for the next tranche of its loan.

However, Finance Ministry sources said no dates for the IMF review mission had been finalized yet.

Finance Minister Ishaq Dar would leave for Geneva along with PM Shehbaz and meet IMF officials on the sidelines of a conference there. The conference has now been lowered to a climate resilience event from a donors’ conference because of lack of interest by major players.

The premier’s direct intervention in the IMF programme talks suggests that the matters have slipped out of the hands of the Finance Ministry.

The 9th review talks have been pending since October last year, resulting in the withholding of a $1.1 billion loan tranche. Pakistan is keen to complete the 9th review so that the World Bank and Asian Infrastructure Investment Bank (AIIB) may also release their loans.

Friends to rescue

Finance Minister Ishaq Dar asserted that Pakistan would soon get from friendly countries, including Saudi Arabia. Talking to journalists in Islamabad, he said the government was repaying the country’s due debt on time, regretting that the country’s foreign exchange reserves were plunging due to external debt payment. “Pakistan’s forex reserves will get better soon”, Dar said, pointing out that the reserves held by the State Bank declined by $1.2 billion to reach $4.5 billion.

He further said that the net foreign reserves held by commercial banks stood at nearly $6 billion. He added that the country would soon get help from friendly countries, including Saudi Arabia. Dar announced that he would also undertake a three-day official visit to the United Arab Emirates (UAE) following the ‘Climate Resilient Pakistan’ moot.

Suzuki extends plant closure

Meanwhile, Pak Suzuki Motor Company Ltd (PSMCL) has extended plant shutdown from Jan 9-13 due to a continued shortage of imported parts.

“Due to the continued shortage of inventory level, the management of the company has decided to extend the shutdown of the automobile plant from January 9, 2023, to January 13, 2023,” PSMC said in an announcement made to the Pakistan Stock Exchange. However, the motorcycle plant would remain operative, it added.

Earlier, the company suspended production activities from Jan 2-6. The firm stated that its supply chain is affecting due to restrictions of the State Bank of Pakistan (SBP).

The export consignments are affecting due to the conditional permission, said the company, adding that the restriction damaged the inventory. Previously, the Indus Motor Company (IMC) had announced to shut down its manufacturing plant for 10 days due to the imposition of a ban on the imports of completely knocked down (CKD) kits by the central bank.

Pakistan’s biggest agricultural machinery manufacturer, Millat Tractors Limited, said on Thursday that it would remain closed from January 6 till further notice, citing reduced demand and cash flow problems.

In a regulatory filing, it stated, “Due to continuing reduced demand for tractors and cash flow constraints, the company will remain closed from Friday January 6, 2023 till further notice.” Millat Tractors Limited had earlier announced that it would observe Fridays as non-production days (NPDs) from Dec 16.

A number of auto part vendors have suspended operations in recent months, citing reduced demand and import curbs imposed by the State Bank of Pakistan (SBP) – that were lifted last week – among other issues. Some textile companies have also partially suspended production recently due to demand destruction and market conditions.