Health professionals and anti-tobacco campaigners are urging the government to align cigarette taxes with World Health Organization (WHO) guidelines to shield the nation’s youth from the perils of smoking, exacerbated by the current affordability of cigarettes.

The low taxation on cigarettes in Pakistan renders them inexpensive, leading to a surge in smokers annually and an accompanying rise in smoking-related illnesses, amplifying the healthcare expenses for the government.

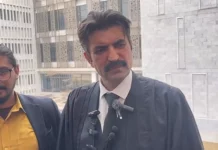

Dr. Maleek Haider encounters numerous patients suffering from smoking-related ailments. “Many of my patients are economically disadvantaged and serve as the primary breadwinners in their families. I’ve noticed that they often start smoking at a young age and fall ill before reaching 30,” he observed.

His observations echo the findings of a recent study on smoking in Pakistan conducted by the Pakistan Institute of Development Economics (PIDE), which reveals that 86 percent of the costs associated with smoking-induced diseases are borne by individuals aged 35 to 64. Alarmingly, the study also indicates that smoking-related mortality and morbidity costs amount to 1.6 percent of the country’s GDP, while Pakistan allocates less than 1 percent of its GDP to healthcare.

Explaining the reason behind the affordability of cigarettes, the study points to the disregard for WHO guidelines. These guidelines suggest a threshold of 70 percent of the retail price or the level necessary to cover tobacco-related costs incurred by the country.

The study recommends a substantial increase in cigarette taxes, with a focus on aligning rates with WHO guidelines. In the short term, taxes on both tiers should be raised, with a greater increase for the second tier to narrow the gap between them. Eventually, a transition to a single-tier system is proposed, aiming to uplift the impoverished from the cycle of poverty and alleviate the burden of smoking-related diseases.

Despite generating Rs 150 billion in revenue from cigarette taxation in the fiscal year 2021-22, the economic and health costs imposed by smoking on society surpass this figure by 3.65 times. Smoking-attributable direct costs account for 8.3 percent of total healthcare expenditures, while the total economic cost of smoking nearly equals public sector health spending.

Anti-tobacco campaigners advocate for prioritizing increases in cigarette taxes over hikes in utility tariffs such as electricity and gas. Malik Imran Ahmad, Country Head of the Campaign for Tobacco-Free Kids (CTFK), highlighted the high prevalence of tobacco use in Pakistan, with an estimated 31.9 million adults consuming tobacco products, constituting approximately 19.7% of the adult population.

It is estimated that smoking-induced illnesses contribute to over 160,000 deaths annually in Pakistan. Dr. Aman Khan, Director of the Waseela Foundation, expressed concerns about the influence of multinational cigarette manufacturers on media messaging, noting their ability to manipulate public perception regarding smoking prevalence. He emphasized the need for the government to craft a modern narrative to counter smoking, considering the evolving nature of media platforms.